Investing is a game errors where success means making few good decisions but fewer mistakes.

“You just want to make sure you don’t make any mistakes that take you out of the game or come close to taking you out of your game.” Warren Buffett

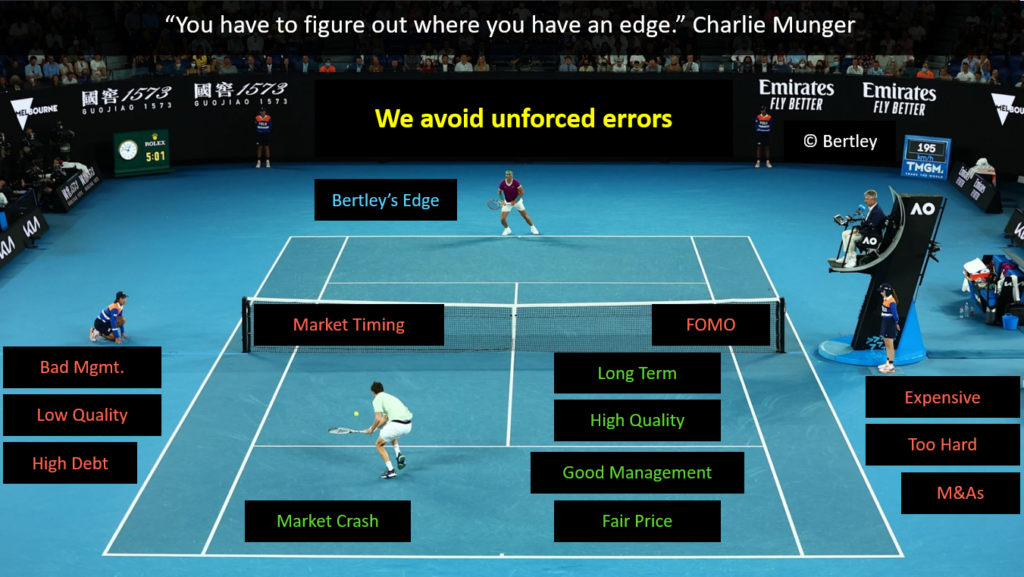

In investing, avoiding mistakes is more important than making good investments. We avoid certain risks we can control.

At Bertley Capital, we embrace a long-term perspective. Our strategy involves buying high-quality companies run by exceptional management teams at reasonable prices. Leveraging market fluctuations, we invest in high-quality businesses when they are attractively valued.

We diligently avoid low-quality companies, ineffective management, high-debt companies, overpriced stocks, merger and acquisition scenarios, and the fear of missing out (FOMO).